No products in the cart.

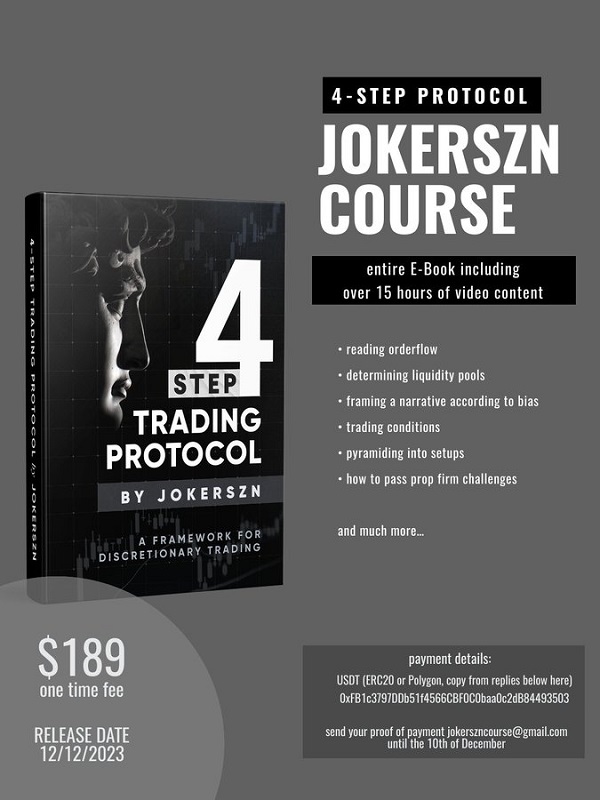

What Will You Get:

- Reading orderflow

- Determining liquidity pools

- Rraming a narrative according to bias

- Trading conditions

- Pyramiding into setups

- How to pass prop firm challenges

- and much more…

Sales Page:_https://twitter.com/joker_szn/status/1720440690646090170?s=20

Delivery time: 12 -24hrs after paid

Be the first to review “[GroupBuy] 4-Step Trading Protocol by JokerSZN” Cancel reply

Related products

Forex & Trading

$59.00

Sale!

Forex & Trading

$5.99

Forex & Trading

$59.00

Sale!

Forex & Trading

Forex & Trading

$34.99

Sale!

Forex & Trading

Sale!

Forex & Trading

Reviews

There are no reviews yet.